Anyone looking to begin currency trading needs to know the basics of the Forex market. The first step to master Forex trading is understanding how this international market operates, the participants involved, and important trading terminologies. This article will help you understand these concepts, no matter whether you are new to trading or seeking to brush up on your knowledge.

What Are the Basics of the Forex Market

Currency buying and selling take place in the foreign exchange market, or Forex market. It is the biggest financial market in the world and is open twenty-four hours a day, five days a week. Forex trading occurs over the counter (OTC), which means that transactions are carried out directly between participants, includes banks, institutions, and individual traders, in contrast to a traditional stock exchange.

Learning about currency pairs is the first step towards understanding the basics of the Forex market. A quotation of two distinct currencies, such as EUR/USD, in which the base currency is the first and the quote is the second, is called a currency pair. The goal of traders is to make profit off any fluctuations in the exchange rates between these pairs.

How Currency Pairs Work

Currency pairs are always traded in forex trading, which means you are trading one currency against another. Every pair of currencies has two parts:

Base Currency

The pair’s first currency is this one. It is the money that you are buying or selling off.

Quote Currency

This is the pair’s second currency. It shows how much the base currency is worth with respect to of the quote currency.

Example

EUR/USD (Euro/US Dollar)

Base Currency: EUR (Euro)

Quote Currency: USD (US Dollar)

You are looking at how much of the quote currency (USD) required for the purchase of one unit of the base currency (EUR) in this instance.

How it Works

One euro is worth 1.20 US dollars if the EUR/USD exchange rate is 1.2000.

Buying EUR/USD: Purchasing this pair involves simultaneously purchasing Euros and concurrently selling US Dollars. You wish to sell the USD and purchase additional Euros because you anticipate that the Euro will rise in value relative to the US Dollar.

Selling EUR/USD: You are purchasing US dollars and selling euros if you sell this pair. You wish to buy back the USD for less than you sold it for because you anticipate that the Euro will begin to lose value in relation to the US Dollar.

In this scenario, you are constantly purchasing one currency and selling another, and the change of the exchange rate determines whether you make money or lose it. Your deal turns into a profit if the base currency increases in value in relation to the quote currency. On the other hand, you lose money if the base currency depreciates.

🌟 Want to Open a Reliable Forex Account? 🌟

👉 Click Here to Get Started💼 Your journey to success begins now! 💸

Key Participants in Forex Market

1. Central Banks

Central banks, like the Federal Reserve in the U.S. or the European Central Bank (ECB), have a significant impact on currency values. They use monetary policy tools like interest rates and money supply to stabilize and control the economy.

Example

Interest Rate Changes

Suppose the U.S. Federal Reserve raises interest rates from 1% to 1.5%. This attracts more foreign investors to the U.S. because they can earn higher returns on their investments. As a result, demand for the U.S. dollar increases, which strengthens the dollar against other currencies.

On the other hand, if the Federal Reserve cuts interest rates or prints more money, the U.S. dollar could weaken because more dollars are in circulation, lowering its value.

Impact on Forex market

Traders closely follow these decisions because they can predict which way a currency will move. For instance, if you’re trading USD/JPY, and you know the Federal Reserve will increase interest rates, you might expect the U.S. dollar to strengthen against the Japanese yen.

2. Commercial Banks

Commercial banks are huge players in the Forex market. They handle large transactions on behalf of their clients, including other banks, corporations, and governments. They provide liquidity, which ensures the market functions smoothly.

Example

Currency Exchange for Business Transactions

Imagine a U.S. company, ABC Inc., wants to import electronics from Japan and needs to pay in yen. To do this, ABC Inc. would need to convert U.S. dollars into Japanese yen. The bank facilitating this exchange will buy yen and sell U.S. dollars in large amounts, adding liquidity to the market.

Another example is when a bank like JPMorgan Chase conducts transactions to fulfill the needs of its clients or adjust its own currency holdings.

Impact on Forex market

Commercial banks are involved in transactions worth billions of dollars every day. Their large-scale trades can move the market. If a commercial bank buys large quantities of a currency, it will increase demand for that currency, which can raise its price.

3. Corporations

Corporations often need to exchange currencies for their international business operations. This includes paying for goods, services, and salaries in foreign currencies.

Example

Company Expanding Globally

Let’s say Toyota, a Japanese car manufacturer, has a factory in the U.S. and needs to pay its employees in U.S. dollars. Toyota will exchange Japanese yen for U.S. dollars. The demand for U.S. dollars increases, which could push up the value of the dollar against the yen.

Exports and Imports

If a U.S. company exports products to Europe and receives payment in euros, the company will need to exchange those euros for U.S. dollars. This is another case where corporations are directly involved in currency exchanges.

Impact on Forex market

Corporations’ currency exchanges can cause fluctuations in the market, especially when large multinational companies make payments or receive funds in foreign currencies. These trades often happen in large amounts, influencing currency prices.

4. Retail Traders

Retail traders, like you and me, are individuals who trade currencies for personal profit. We typically trade smaller amounts compared to commercial banks or corporations, but our combined actions still affect the market.

Example

Retail Trader Buying EUR/USD

A retail trader may believe that the Euro is going to rise in value against the U.S. dollar. They buy the EUR/USD pair. If many other retail traders believe the same thing and buy EUR/USD, the demand for euros increases, causing the euro to rise against the dollar.

Trading Platforms

Retail traders usually trade through online platforms like MetaTrader via brokers. These platforms give us access to the market but handle our trades in smaller quantities compared to institutional traders.

Impact on Forex market

While each individual retail trade may be small, the volume of trades from millions of retail traders worldwide can have a collective impact on the market, especially during periods of high volatility or news events that drive trader sentiment.

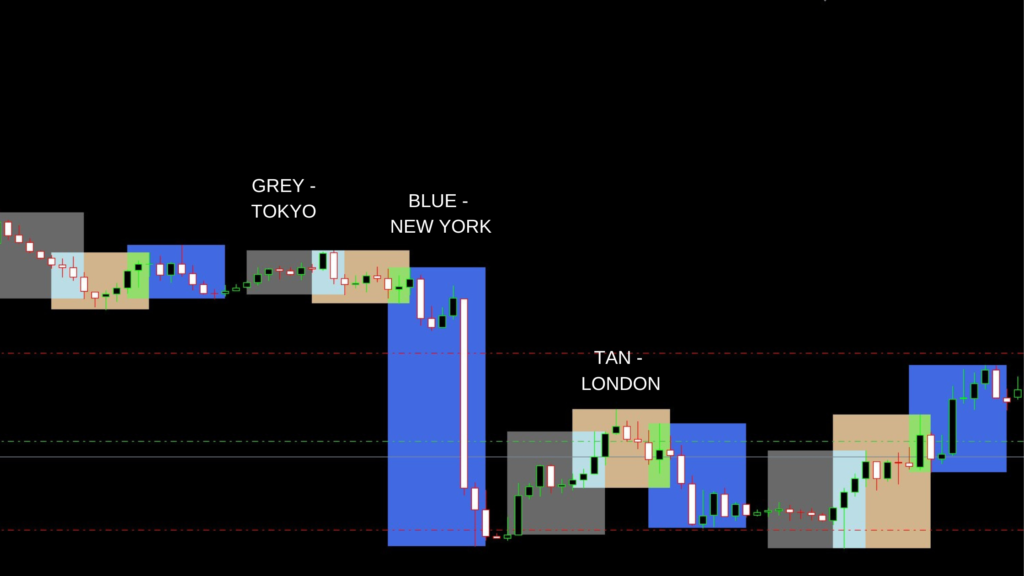

Trading Sessions in the Forex Market

The Forex market operates 24 hours a day, divided into four major trading sessions. These sessions are based on the business hours of key financial centers around the world, creating a continuous cycle of activity

1. Sydney Session (3:30 AM – 12:30 PM IST)

Begins the Forex trading day with low volatility. Best Currency Pairs to Trade are AUD/USD, NZD/USD.

You can trade AUD/USD in the early morning before other sessions begin.

2. Tokyo Session (5:30 AM – 2:30 PM IST)

The Tokyo session brings more activity, especially for yen pairs. Best Currency Pairs to Trade are USD/JPY, EUR/JPY, AUD/JPY.

If you prefer early morning trading, the Tokyo session offers movements in JPY-related pairs.

3. London Session (1:30 PM – 10:30 PM IST)

The London session brings significant activity, with high liquidity and volatility. Best Currency Pairs to Trade are EUR/USD, GBP/USD, USD/CHF. This session overlaps with the New York session later, offering great trading opportunities for major pairs.

4. New York Session (6:30 PM – 3:30 AM IST)

Overlaps with the London session initially, offering high volatility and price movements. Best Currency Pairs to Trade are USD/JPY, GBP/USD, USD/CAD. You can trade during the overlap or focus on U.S. economic news releases for price action.

5. Key Overlap Periods (IST)

London/New York overlap: 6:30 PM – 10.30 PM IST

This is the most active and liquid period in Forex trading. Major currency pairs like EUR/USD and GBP/USD experience significant price movements during this time.

This timing guide in IST helps Indian traders plan their trades more effectively. The London and New York overlap (6:30 PM to 10:30 PM IST) is often the best time to trade due to high liquidity and volatility.

Essential Terms to Know in the Forex Market

To get started with Forex trading, familiarize yourself with the following essential terms

1. Pips (Percentage in Points)

A pip is the smallest unit of price movement in a currency pair. For most currency pairs, it refers to a movement in the fourth decimal place. Pips are used to measure profits or losses. If the price moves 100 pips in your favor, you’ve made a profit based on your position size.

Example

If the EUR/USD moves from 1.1050 to 1.1051, it has moved 1 pip.

2. Leverage

Leverage allows you to control a large position with a relatively small amount of capital. It magnifies both potential profits and potential losses. Leverage is a double-edged sword, as it can enhance your returns but also increases the risk of significant losses.

Example

With 100:1 leverage, you can control a position worth $100,000 with just $1,000 of your own money.

3. Spread

The spread is the difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are asking for) of a currency pair. The spread is how brokers make money. A smaller spread is better for traders, as it means lower transaction costs.

Example

If the EUR/USD bid price is 1.1050 and the ask price is 1.1052, the spread is 2 pips.

4. Margin

Margin is the amount of money required to open and maintain a leveraged position. It acts as a collateral for the trade. Margin allows traders to open positions larger than their actual capital. However, if your position moves against you, you may face a margin call and need to deposit more funds to keep the trade open.

Example

If you want to trade 1 standard lot of EUR/USD and your broker requires 2% margin, you would need $2,000 to open the position (for a $100,000 trade).

5. Why These Terms Matter

Understanding these basic terms is crucial to your success as a Forex trader. By mastering them, you can better manage your trades, control risk, and maximize your opportunities. Always keep an eye on your leverage, spread, and margin requirements to ensure you’re trading wisely and safely.

Why Trade Forex

There are many reasons traders are drawn to the Forex market.

1. High Liquidity

Forex is the largest financial market globally, with trillions of dollars traded daily. This high volume ensures that there’s always someone on the other side of your trade, making it easy to buy or sell currencies quickly. Major pairs like EUR/USD and GBP/USD are extremely liquid, allowing for tighter spreads and fast execution, even during volatile market conditions.

2. 24/5 Trading

Unlike stock markets, which have fixed hours, Forex trading operates 24 hours a day, five days a week. This flexibility allows traders to participate in the market regardless of their time zone.You can trade during the London, New York, Tokyo, or Sydney sessions, making it ideal for both full-time and part-time traders

3. Low Costs

Forex trading is relatively affordable compared to other markets, with many brokers offering competitive spreads and low commissions. This accessibility makes it appealing, especially for beginners.A broker might offer a spread as low as 0.5 pips for EUR/USD, ensuring lower costs for entering and exiting trades.

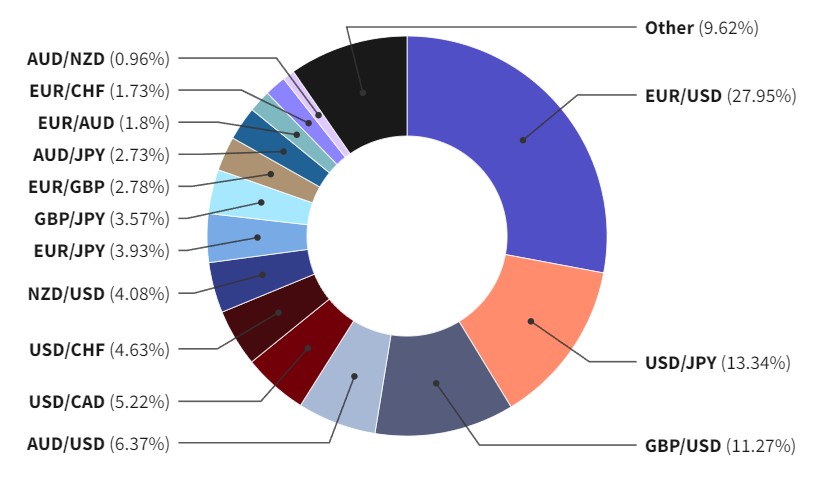

Most Popular Forex Pairs Traded

🌟 Want to Open a Reliable Forex Account? 🌟

👉 Click Here to Get Started💼 Your journey to success begins now! 💸

Tips for Getting Started in Forex

1. Learn the Basics

Before diving into the world of forex trading, it’s essential to have a solid understanding of key trading concepts, chart analysis, and economic indicators. These foundational skills will help you make informed decisions and improve your overall trading strategy.

Here’s a breakdown of the basics you should familiarize yourself with:

Trading Concepts

Understand fundamental concepts like currency pairs, bid/ask prices, leverage, margin, and pips. In the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. A price of 1.2000 means 1 EUR equals 1.20 USD.

Chart Analysis

Learn how to read price charts (line, bar, and candlestick charts) to identify trends, reversals, and key levels of support and resistance. Mastering chart patterns like head and shoulders, double tops/bottoms, and triangles can help you predict future price movements.

Economic Indicators

Stay informed about key economic reports and their impact on currency prices. Indicators such as GDP growth, inflation rates, employment reports, and central bank interest rate decisions provide crucial insights into a currency’s strength.

Recommended Read,

Forex Trading For Beginners – A Simple Guide to Success

This book is an excellent resource for novice traders, providing a step-by-step approach to understanding the fundamentals of forex trading and laying the groundwork for more advanced strategies.

Pro Tip

“Start by focusing on one currency pair, like EUR/USD, and learn how it behaves under different market conditions. This will allow you to gain more confidence before diversifying into other pairs”.

2. Practice on a Demo Account

Trading on a demo account is an essential first step for any aspiring forex trader. It allows you to experience live market conditions without risking your capital. Most reputable brokers provide demo accounts, enabling you to simulate real trading with virtual funds.

Here’s how a demo account can help you

Understand Trading Platforms

Learn to navigate platforms like MetaTrader 4/5 or cTrader, execute trades, set stop-loss and take-profit levels, and analyze charts.

Test Strategies

Develop and refine your trading strategies, such as trend-following or reversal techniques, in a risk-free environment. For example, practice how moving average crossovers work in identifying potential entry points.

Gain Confidence

Familiarize yourself with market volatility and how currency pairs like EUR/USD or GBP/JPY behave during different trading sessions.

Avoid Emotional Trading

By practicing with virtual money, you can manage the psychological aspects of trading, such as fear and greed, without financial pressure.

Example

If you’re learning to trade a breakout strategy, use the demo account to identify support and resistance levels, place pending orders, and monitor how price action unfolds. This helps you understand when and why trades succeed or fail.

Pro Tip

“Treat your demo trading seriously, as if you’re trading with real money. Keep a trading journal to document your decisions and review your performance regularly. This habit will prepare you for transitioning to a live account with confidence and discipline”.

3. Start Small

Starting small is a smart approach when transitioning from a demo account to live trading. It helps you manage risk effectively while gaining practical experience in real market conditions.

Here’s why starting small is crucial,

Risk Management

Trading with a modest initial investment ensures that losses remain manageable as you learn to navigate live markets. Allocate only a small percentage of your capital typically 1-2% per trade to protect your account from significant drawdowns.

Focus on Learning

With a smaller investment, the emotional pressure of trading is reduced, allowing you to focus on improving your strategy and decision-making without being overwhelmed by fear or greed.

Build Confidence

Trading small positions helps you adapt to live trading dynamics, such as slippage, spreads, and market execution, while gradually building confidence in your skills.

Example

If your trading account is funded with $500, consider starting with micro-lots (0.01 lot size) to limit your exposure. For a trade with a 50-pip stop loss, your risk would be approximately $5 per trade, keeping potential losses minimal.

Pro Tip

“As your skills and confidence grow, you can gradually increase your position sizes while adhering to your risk management rules. This steady progression ensures sustainable growth without jeopardizing your account”.

4. Stay Informed

In the fast-moving world of forex trading, staying informed is critical to making well-timed and profitable decisions. Currency prices are highly sensitive to economic events, news releases, and geopolitical developments. Understanding these influences will give you an edge in the market.

Here’s how to stay informed and leverage this knowledge:

Monitor Economic Calendars

Keep track of major economic events such as interest rate decisions, GDP reports, and employment data. For example, the release of U.S. Non-Farm Payrolls (NFP) can create significant volatility in pairs like EUR/USD or USD/JPY.

Follow News Outlets

Stay updated on global news through reliable sources like Bloomberg, Reuters, or ForexFactory. Events such as central bank speeches or geopolitical tensions (e.g., trade wars or conflicts) can drastically move the market.

Understand Market Sentiment

Learn how the market reacts to news. For instance, a better-than-expected GDP growth report could strengthen a currency, while political instability might weaken it.

Stay Ahead of Session Openings

Currency volatility often peaks during the opening of major trading sessions (London, New York, and Tokyo). Being aware of what’s happening before these sessions can help you plan your trades.

Example

If the European Central Bank (ECB) is expected to announce a change in interest rates, monitor related reports and speeches leading up to the announcement. This can help you anticipate potential movements in EUR-related currency pairs, including:

EUR/USD (Euro/US Dollar)

EUR/GBP (Euro/British Pound)

EUR/JPY (Euro/Japanese Yen)

EUR/CHF (Euro/Swiss Franc)

EUR/AUD (Euro/Australian Dollar)

EUR/CAD (Euro/Canadian Dollar)

EUR/NZD (Euro/New Zealand Dollar)

Pro Tip

“Combine fundamental analysis with your technical trading strategy to enhance your decision-making. Use tools like sentiment indicators or volatility charts to prepare for news-related market moves”.